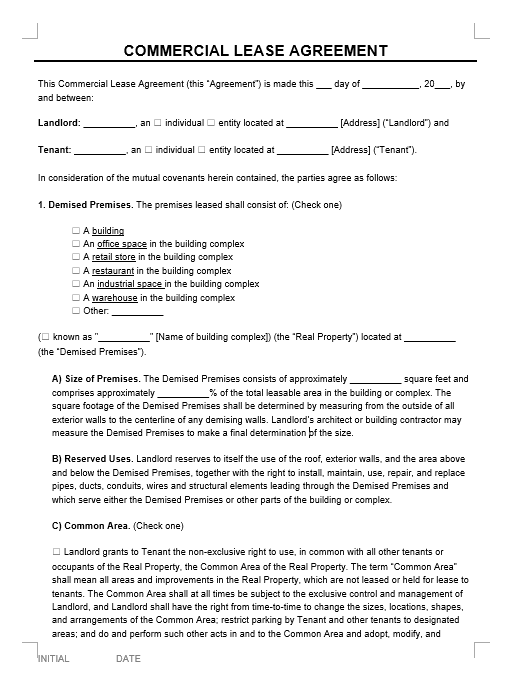

Commercial Lease Agreement

A Commercial Lease Agreement is a rental agreement used to rent out a business property. Completing a Commercial Lease Agreement form gives the tenant the legal right to use the property to operate any kind of business in exchange for an agreed-upon rent payment.

€49,95

What is a Commercial Lease Agreement?

A Commercial Lease Agreement is a formal document between a landlord and a tenant to rent business property. If the tenant plans to operate a business on the landlord’s premises, this agreement allows both parties to formalize the lease and their relationship through a legally recognized document.

Unlike a residential lease agreement, a commercial lease agreement assumes the property is being used for business purposes and not for residential living. The property being leased can be a simple office, an entire building, an independent retail store, a new restaurant, or even a large warehouse for industrial purposes like a manufacturing factory or self-storage facility. If the property being leased is part of a larger building, the landlord can address special concerns and duties about common areas such as parking spaces or lobby areas.

This document allows both parties to formalize their leasing relationship through a legally recognized document.

This document will identify these basic elements:

- Landlord: the party who is renting out the commercial property for money, also known as the lessor

- Tenant: the party who is operating a business and paying for the leased property, also known as the lessee

- Term: the number of years or months the physical space will be needed, which can range from an agreed-upon start and end date; an agreed-upon time period in weeks, months, or years (i.e. 5 years); a periodic tenancy like a month-to-month timeframe; or an automatic renewal which continues to renew until one party sends notice to terminate or end the lease

- Demised Premise: the space actually being rented out by the tenant (like a store in the mall) including a property map with details about the size and whether the tenant has access to services like parking, cleaning, security, snow removal/landscaping, and heating/air conditioning

- Real Property: the entire property owned by the landlord (like the shopping mall where the store is located) which includes shared common areas such as walkways and parking lots that will be used by other tenants

- Base Rent: the starting cost of leasing the space on a monthly or annual basis

- Operating Costs: landlords may ask tenants to share in the cost of operating the entire building and maintaining common spaces including real property taxes, utilities, and collective advertising costs as either a fixed flat fee or designated percentage based on the tenant’s footprint or store size

- Security Deposit: an amount of money given to the landlord to demonstrate the tenant’s good faith efforts to not break the lease early or irreparably damage the property

- Property Use and Occupancy Details: both parties can clearly describe what is and is not allowed in the rented space and common areas, such as smoking, after-hours noise, and dumping garbage, or whether certain business activities like food services can occur in an office building

- Improvements: if the tenant plans on operating a restaurant or another business that requires improvements or construction in the demised premises, both parties should clarify who is responsible for paying and overseeing the construction project

Check your city or state laws regarding whether smoking is prohibited within a certain distance of any doorway. Of note, smoking bans are becoming the norm — all bars and restaurants in the 60 most populated cities in the U.S. do not allow you to smoke.

Keep in mind that this document is sometimes referred to by other names:

- Business Lease

- Industrial Lease

- Office Space Agreement

- Standard Commercial Lease

What exactly is the difference between the “real property” and the “demised premises”?

The real property is the whole property owned by the landlord. The demised premises is the actual rented space within the real property. For example, a shopping mall has lots of different stores and common spaces within the building and common spaces like parking and walkways located outside the building. The real property is the entire shopping mall, such as the stores plus the common spaces inside and outside the building. The demised premises is one of the stores in the mall.

It is the same scenario for an office building. The real property is the whole office building (or office park), and the demised premises is one of the office suites that is being leased.

The 4 Types of Commercial Lease Agreements

In general, there are three main categories of Commercial Lease Agreements based on how base rent and operating expenses are paid by the tenant.

Full Service or Gross Lease

In a full service or gross lease, the rental rate includes all operating expenses. Any operating expenses or real estate taxes are already factored into the base rent. However, the landlord can expressly reserve the right to pass down any future increases in operating expenses to the tenant.

<h3″>Net Lease

In a net lease, none of the operating expenses are included in the rental rate. Therefore, in addition to the base rent, the tenant must also pay its pro rata portion of the three “net” operating expenses – property taxes, property insurance and common area maintenance (CAM). CAM generally also includes common area utilities and operating expenses as well. The different types of net leases include:

- Triple Net Lease – the tenant pays for property taxes, property insurance, and CAM

- Double Net Lease – the tenant pays for property taxes and property insurance

- Single Net Lease – the tenant pays for property taxes

Modified Gross Lease

A modified gross lease is a hybrid between a gross lease and a net lease. In a modified gross lease, the operating expenses are negotiated and shared between the landlord and the tenant. Usually, the tenant is responsible for the base rent and CAM, and the landlord is responsible for the property taxes and property insurance. Sometimes, the tenant pays base rent only at the beginning of the lease, and then begins to pay a portion of the operating expenses later in the lease.

Percentage Lease

In a percentage lease, the tenant pays the base rent on the property as well as a monthly percentage of the gross revenue from the business operating the rented space. This type of lease is usually used for retail businesses.

Who Should Use a Commercial Lease?

This lease can be used for many different types of rental spaces including for an office, a clinic, a warehouse, or a store.

A Commercial Lease Agreement can be used to cover many different kinds of rented spaces:

- Accounting Firm

- Business Office

- Child Care Facility

- Factory

- Hotels or Guesthouses

- Legal Office

- Medical Clinic or Health Care Facility

- Restaurant

- Startup Company

- Self-Storage Facility

- Shopping Mall Store

- Trade Businesses

- Warehouse

In addition to traditional businesses, leases can also be used for private land. In Montana, nearly a one-third of the state’s private land is leased to hunting outfitters.

When is a Commercial Lease Agreement Needed?

If you’re a small business owner needing office space or the owner of a building wanting to rent out units in your building, this document is needed to memorialize everyone’s obligations and clarify expectations. When negotiating this kind of agreement, both the landlord and tenant should clarify any concerns they may have about how the space will be used and what is needed for business operations.

A residential lease agreement may need to follow consumer protection laws that put caps on how much landlords may charge for security deposits or protect tenants’ basic rights to hot water and heating or air conditioning. In contrast, state laws governing business leases often do not impose such minimum or maximum requirements on landlords. Even if your state has specific requirements and procedures that apply to commercial landlords and tenants, in some instances a lease agreement might continue to trump the default laws.

If the commercial property tenant is operating a business open to the public and hires more than 15 people, the Americans with Disabilities Act (ADA) applies and requires doors be widened or ramps be installed. Should the landlord or tenant pay for these modifications? Learn more about who’s responsible for ADA compliance, and be sure to memorialize your decision in writing.

Accordingly, tenants and landlords should carefully negotiate the terms of this agreement to ensure each party is properly protected and obligations are clearly spelled out.

Be sure to record all decisions like who is responsible for repairs in writing since courts have a more difficult time enforcing verbal agreements. Learn more about what to do “When Good Leases Go Bad.”

Specification: Commercial Lease Agreement

|

Vendor Information

- Store Name: EMC Consultancy

- Vendor: EMC Consultancy

-

Address:

Groenstraat 27

4841BA Breda - No ratings found yet!