Quitclaim Deed Form

A quitclaim deed is a legal document used to quickly and easily transfer the ownership of real estate to another person. Unlike a warranty deed, which is also used to transfer property, a quitclaim deed does not include any guarantee that the grantor (person transferring the property) has full ownership.

This means that the grantee (person receiving the property) will not get full ownership if there are any outstanding liens or other such legal claims on the property. As a result of this risk, quitclaim deeds are usually only used when transferring property between two people who trust one another, such as family members or friends.

€105,00

What is a Quitclaim Deed?

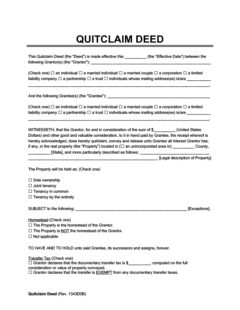

A quitclaim deed form (or quit claim) is a legal document where the Grantor (or owner/seller) releases their ownership rights of a piece of real property to the Grantee (or purchaser). Without this document, an individual may not be able to record and prove their ownership of the property.

A simple quitclaim deed should identify the following basic elements:

-

- Grantor: the name and mailing address of the individual(s) or corporation who currently owns the property.

- Grantee: the name and mailing address of the individual(s) or corporation who will become the new owner.

- Consideration: how much, if anything, is being paid for the property.

- Legal Description: a land description in words that identifies a particular piece of property.

- Parcel Number: the number assigned by the tax assessor (usually listed on your property tax statement).

- Preparer: the name and mailing address of the person who prepared the document

- Witnesses: the individuals who watch the Grantor and Grantee sign the quitclaim deed. Note that depending on the laws of your state, there could be anywhere from zero to two witnesses required.

- Notary: a notary public who verifies that the signatures are authentic.

As a reference, a quitclaim deed may also be referred to as:

- Quit Claim Deed (although this spelling is incorrect!)

- Quick Claim Deed (also incorrect!)

Warranty Deed vs Quitclaim Deed vs Special Warranty

Other than quitclaim deeds, there are two types of deeds that offer protection and warranties for the Grantee. The most common types are Special Warranty and General Warranty Deeds, which promise that the Grantor has the right to transfer ownership of the property, and warrant against certain defects in title.

Here is a table comparing the three most common types of property deed transfer forms:

And here are three less common (but still important) types of property deed transfer forms used in more specific scenarios:

Grant Deed – generally used in place of a California quitclaim deed when transferring property to non-relatives in that state, a grant deed discloses that the Grantor has not transferred the title to anyone else, and the property has no undisclosed liens or encumbrances. However, note that it does not provide any warranties.

Bargain and Sale Deed – used in certain states such as New York and Washington, this type of deed implies that the Grantor has title to the property. It also does not provide any warranties.

Lady Bird Deed – or enhanced life estate deed – is especially used in certain states like Florida and Texas. A lady bird deed allows the Grantor to retain a life estate with very few restrictions while also receiving certain tax benefits.

Make sure to review all of the different types of deeds in detail to ensure you have selected the right one for your real estate transfer or sale.

2. What is the Purpose of a Quitclaim Deed?

The purpose of a quitclaim deed is simply to transfer ownership of property to another party. In a quitclaim deed, the Grantor only transfers whatever title or ownership, if any, they have at the time of the transfer. The Grantor does not provide any warranties as to the quality of the title. It is important you sign a quitclaim deed when handing over the rights to your property.

In some situations, all that is needed is a simple, quick transfer of property — one without the time, expense and assurances of a special warranty or general warranty deed. Often with a quitclaim, little or no money is transferred, so any loss associated with a defect in title would be low, or the transfer is between family members and the risk of a title defect is minor.

Although this document provides no promises as to ownership or title, many states have an implied good faith presumption that the Grantor is not aware of any other owners or conflicts, or an expectation of good faith that the Grantor is free to transfer the title.

How Does a Quitclaim Deed Work?

A quitclaim deed form conveys whatever ownership, if any, the Grantor has in the property. Here are the different types of ownership it might convey:

- Fee Simple – owned completely by one person

- Joint Tenancy – owned equally by two or more people with right of survivorship and no right to sell interests

- Tenancy by the Entirety – a joint tenancy between a husband and wife

- Tenancy in Common – owned by two or more people with no right of survivorship and the right to sell interests freely

3. When to Use a Quitclaim Deed

A quitclaim deed form only changes the ownership of the property. If the Grantor has a mortgage on the property, he or she is still responsible for that mortgage.

What do you actually need to include in this document? Ensure you have all the right information before you proceed.

Quitclaim deeds are most often used for intra-family transfers, estate planning, or to cure a title defect.

Here are some examples:

- Divorce: one spouse releases claim to the home after a divorce settlement

- Marriage: spouse wants to add their new spouse to the title

- Chain of Title Defect: title insurance company finds someone with potential interests to the property and asks them to waive those interests

- Title Defect: removing “clouds” in the title such as fixing a misspelled name or other mistake

- Family: parent grants title to a child, or transfers property between siblings

- Estate Planning: person transfers property to a trust

- Business: transfers between parent companies to subsidiaries

- Public Auction Sale: tax / public auction sale where buyer assumes the risk of a defective title

How to Fill Out a Quitclaim Deed

There are several things to take into consideration when creating your quitclaim deed form. Here are some important factors to consider.

First, it should include the following:

- Who is the Grantor and the Grantee, plus their addresses

- The name and address of the preparer

- Where is the property located, including a legal description

- When the deed was executed

- Why the property is being transferred (in exchange for consideration)

- How the property is being transferred (quitclaim)

In addition to the above basic provisions, here are some additional terms you may want to include if they apply to your property:

- Easements: the Grantor can reserve the right to continue using a portion of the land, such as access to a private road or fishing pond

- Encumbrances: are there any encumbrances to the property the Grantor is aware of

- Life Estate: the Grantor can reserve a life estate interest in the property, usually for tax purposes, allowing the Grantor continued use of the property until his or her death

- Mailing Address: where to return the original deed once recorded

- Mineral Rights: the Grantor can reserve all or a portion of any remaining interests in the property’s subsurface oil, gas, or other mineral rights

- Spousal Acknowledgment: if the Grantor’s spouse is not signing the deed and the property is a homestead, the spouse should sign an acknowledgment waiving any current or future interests in the property

- Taxpayer: the taxpayer’s name and address for tax bills

How to File a Quitclaim Deed

Quitclaim deeds should be filed with the local recording office to give public notice of and create a priority for the Grantee’s claim of ownership.

Without a quitclaim deed, you may not be able to record and prove your ownership to the property. While filing with the local county clerk does not guarantee a perfect title, it does create a public record of your claim to ownership.

Any title search of the property after the recording will include your quitclaim deed. And any deed filed after your recording will be junior to your claim.

What are Homestead Rights?

Some states have homestead requirements where a spouse cannot sell or transfer the homestead without the signature or acknowledgment of the other spouse.

In addition, spouses may have inheritance, or dower and curtesy rights, if the property is community property. If only one spouse is the Grantor and the one signing the quitclaim deed, the other spouse should sign an acknowledgment waiving and releasing any possible residual rights.

What are the Tax Implications of a Quitclaim Deed?

After the Grantor transfers ownership of the property, the obligation to pay the property taxes falls to the Grantee, and tax bills will be mailed to the address on the deed.

Some states impose a real estate transfer tax on property transfers. The transfer tax is usually a small percentage of the consideration or purchase price. However, most states provide various exemptions from the transfer tax, such as transfers between parents and children.

Other taxes such as federal income tax, gift tax, or inheritance tax may also be incurred by a quitclaim deed transfer. Consult a tax lawyer or certified public accountant to learn more.

Specification: Quitclaim Deed Form

|

User Reviews

Be the first to review “Quitclaim Deed Form”

Vendor Information

- No ratings found yet!

There are no reviews yet.