Prenuptial Agreement

A prenuptial agreement, or “prenup,” is a written contract that is entered into before a couple gets married — most commonly when they are engaged. This agreement defines the financial and property rights of each spouse should the marriage end in separation, specifically by death or divorce.

While they all have the same meaning, prenups may also be referred to as:

- Antenuptial agreement

- Prenuptial contract

- Domestic contract

- Marriage contract

- Premarital agreement

€49,95

Prenuptial agreements serve to protect the financial and property rights of a couple should they ever divorce. This includes:

- Separate or Non-marital Property

- Marital Property

- Business Ownership

- Savings and Retirement

- Alimony and Spousal Support

Separate Property / Non-Marital Property

In the event of a divorce, the court will generally divide marital property between both parties, but exclude assets known as “separate property” or “non-marital property.” However, during marriage, commingling—or mixing—separate property may occur and cause property to lose its separate status.

To prevent this, a prenuptial agreement can be used to designate which partner gets what in the event of a divorce, regardless of commingling.

Separate or non-marital property includes:

- Premarital property (property individually acquired before marriage)

- Any inheritance or gift received from a third party during marriage

- Compensation from most personal injury awards

- Property acquired after separation

Marital Property

Anything acquired during marriage by either partner is generally regarded as shared marital property that belongs equally to each partner. However, a prenuptial agreement can be used to exclude certain property from being considered marital property, or “community property”.

Marital property includes:

- Earnings by each spouse during the marriage

- Property bought using either spouse’s earnings during marriage

- Separate property that has commingled with other marital property (e.g., an individual bank account in which both spouses deposit funds)

Business Ownership

If one spouse began a business prior to getting married, the other spouse may be entitled to 50% of any increased value in the business that occurred during the marriage.

With a prenup, however, business owners can designate the status of a business owned prior to marriage as separate property. In the event of a divorce, this agreement would ensure that the business owner possesses exclusive rights to the business.

Savings and Retirement Goals

Couples can use prenuptial agreements to make concrete future financial plans together and decide how they will invest, save, or spend their money.

For example, each spouse can agree to contribute a certain amount of money into joint bank accounts or determine a regular spending allowance. Similarly, a prenuptial agreement can clarify whether joint household expenses, like a mortgage, will be paid from separate or joint bank accounts.

Alimony and Spousal Support

A prenuptial agreement can explicitly determine that the more disadvantaged partner will or will not receive financial support. State laws, however, vary on whether a spouse can completely waive or give up the right to receive alimony or spousal support.

When determining alimony, a judge and spouse may consider:

- If there is no spousal support, will the spouse become destitute and unable to provide for themselves?

- Does the poorer spouse have limited business experience?

- Did the richer spouse fully disclose all their assets and wealth?

- Did the disadvantaged partner truly understand the rights they were giving up?

Children from a Previous Relationship

If one partner has children from another relationship, a prenup can ensure that separate premarital property is shared with these children. Even when a will exists, prenuptial agreements can clarify and reinforce expectations to avoid costly legal battles that ultimately eat away at the estate.

Note: A prenuptial agreement cannot be used for unborn children from a new marriage.

Who Needs a Prenup?

Modern couples of all backgrounds are turning to prenuptial agreements more and more these days. No longer an exclusive marriage contract for the wealthy or the elite. More and more couples of all backgrounds are turning to prenuptial agreements to protect their future.

Consider using a prenup if you want to:

Be practical. If there is a large wealth or property disparity between spouses, a prenuptial agreement can protect those assets in the event of a divorce or sudden departure

Spell out your financial obligations. Couples that have differences in income may consider signing a prenup as both spouses will be entitled to some portion of that money unless clearly defined. A prenup will also help shield each of you from financial responsibility if either you or your spouse have accrued a large amount of personal debt. Additionally, you may want to decide how to disperse any accumulated retirement benefits or determine how each spouse will pay household bills.

Protect your property. If you’re a real estate owner, a prenuptial agreement can determine what is and isn’t community property in your marriage. Owners or partners of a company, nonprofit, or business should keep in mind that your spouse can claim more than half of your company’s value appreciation.

Keep it in the family. If you’re concerned about maintaining children from a previous relationship as your beneficiaries, be sure to spell that out in a prenuptial agreement. Without a prenup, your partner may be able to receive a portion of any inheritance you expect to or have already been granted.

For all their benefits, prenups aren’t always the best option.

You shouldn’t consider using a prenup if any of the following occur:

You don’t feel the prenup is fair. You should never be coerced into signing a prenup. If you feel that a prenuptial agreement is heavily in favor of one spouse over the other, do not sign. Always make sure that a lawyer has looked over the agreement before agreeing to anything. Furthermore, if you and your spouse agree with your state’s default divorce law, creating a prenuptial agreement would be pointless.

Neither of you have much in savings. If neither spouse has any sizable assets or property to their name, a prenuptial agreement will rarely be of any use as protecting assets is the primary purpose of a prenup.

You’re avoiding familial obligations. Any couple that wishes to preemptively limit future custody or visitation rights of children should think twice before getting involved with prenuptial agreement. A prenup should not be used to waive child support obligations, alimony, or spousal maintenance.

For more information, read the following resources:

- 5 Ways a Prenup Can Divorce-Proof Your Marriage

- The Case for the Prenup

- Can I Keep My Engagement Ring?

Do same-sex couples need this document?

After the June 2015 Supreme Court ruling in Obergefell v. Hodges, and the legalization of same-sex marriage nationwide, the IRS weighed in on same-sex marriages for federal tax purposes. According to a 2013 Forbes article, even before the landmark Supreme Court ruling, same-sex couples would have benefitted from a prenuptial agreement.

Prenuptial Agreement: Pros and Cons

The pros and cons of prenuptial agreements can vary on a case-by-case basis.

The topic of prenups can be seen as a violation of trust in some relationships. Even though it’s a practical and important marriage contract, many people consider prenups to be an anticipation of the worst outcome before ever saying their vows.

However, the advantages of a prenup tend to outweigh the disadvantages. If you or your spouse incurred significant debt before marriage, a prenuptial agreement can protect each of you from taking on responsibility for that debt.

For instance, spousal income in a state with community property laws is considered equally shared between both individuals. This means if a creditor attempts to garnish wages in order to repay a debt in default belonging to your spouse, they may be able to garnish your income to facilitate repayment.

How to Get a Prenup

Use Legal Template’s Builder

Our online prenup builder will help reduce the amount of time billed by costly lawyers. Before hiring an attorney, first use our builder to create and print out a prenuptial agreement for them to review.

Do It Yourself Prenuptial Agreement

If you prefer to take a hands-on approach, download one of our free prenuptial agreement samples and fill it out yourself. Be sure to include each spouse’s full name and address as part of the contact information. Before signing a prenup, you will also need to include the following information in later sections:

Explain the marital background of both parties. You’ll want to outline any previous marriages of you and your future spouse. This includes any children from a previous marriage.

Clarify your legal representation. Spell out the names and addresses of any attorneys associated with your prenuptial agreement.

Disclose all financial situations. Outline the bank accounts of both spouses as well as any debts or loans you both may have. Credit card balances will also need to be addressed as these can be considered accrued debts. Additionally, lay out any property, stocks, or retirement accounts of either spouse and any businesses owned by either individual.

Hire a Prenup Lawyer

It’s important to get an impartial third party to comb over any legal agreement before you sign your name. This will ensure that you’re being represented fairly and your assets are substantially protected. Use these simple tips when looking for a prenup lawyer:

- Try a quick Google search for a local lawyer. Just type “prenup lawyers near me”.

- Check out LegalMatch.com to find local attorneys in your area.

- Before settling, be sure to research each lawyer you consider. Visit Martindale.com and explore their extensive database of legal professionals.

Prenuptial Agreement Samples (PDF & Word)

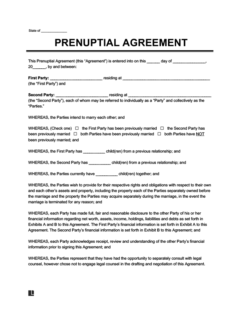

Download this prenup template into MS Word, or view a completed prenuptial agreement sample PDF to see what this document looks like filled out. You can also click on the image to zoom in on the text if you want to read any of the prenup’s clauses.

PRENUPTIAL AGREEMENT

This Agreement is entered into on this __________, by and between __________ (hereafter referred to as “__________”) and __________ (hereafter referred to as “__________”).

- Purpose. The parties intend to marry each other on ____________ in ____________, ____________. In advance of their marriage, the parties wish to provide for their rights and obligations in and to each other’s assets and property including that which each of the parties currently and separately own, that which each will acquire separately during the marriage and that which both will acquire together during the marriage, in the event the marriage is terminated.

- Current Circumstances. With respect to current circumstances:

(a) __________ currently resides at __________, __________, __________ __________. __________ represents that he or she was not previously married. _________ has no children.

(b) __________ currently resides at __________, __________, __________ __________. __________ represents that he or she was not previously married. _________ has no children.

- Effective Date. This Agreement will be effective on __________, the date of marriage. If we do not marry each other by such date, this Agreement will be null and void and its provisions unenforceable.

- Disclosure. The parties have made full, fair and reasonable disclosure to each other of his or her financial information regarding net worth, assets, income, holdings, liabilities and debts as set forth in Exhibits A and B to this Agreement. __________’s financial information is set forth in Exhibit A to this Agreement. __________’s financial information is set forth in Exhibit B to this Agreement. __________ acknowledges receipt, review and understanding of __________’s financial information prior to signing this Agreement. __________ acknowledges receipt, review and understanding of __________’s financial information prior to signing this Agreement.

- Legal Representation.__________ and __________ represent that they had the opportunity to consult with legal counsel however chose not to engage legal counsel in the drafting and negotiation of this Agreement. The failure to consult legal counsel constitutes a waiver of such right. Both parties represent that they understand the contents of this Agreement, acknowledge this Agreement is fair and reasonable and have chosen to freely and voluntarily enter into this Agreement.

- Premarital Property. With respect to premarital property:

(a) All of __________’s property listed in Exhibit A that is separately owned prior to the marriage will remain as __________’s non-marital, separate and individual property during and after the marriage. Any increase in the value relating to the separate property will also remain as the non-marital, separate and individual property of __________. __________ has the full right and authority to manage, sell, gift, transfer or otherwise dispose of __________’s separate property.

(b) All of __________’s property listed in Exhibit B that is separately owned prior to the marriage will remain as __________’s non-marital, separate and individual property during and after the

marriage. Any increase in the value relating to the separate property will also remain as the non-marital, separate and individual property of __________. __________ has the full right and authority to manage, sell, gift, transfer or otherwise dispose of __________’s separate property.

- Property Acquired During Marriage. With respect to property acquired during marriage:

(a) Property earned, acquired and given to __________ individually during marriage will be treated as __________’s and remain __________’s non-marital, separate and individual property. Any increase in the value relating to the separate property will also remain as the non-marital, separate and individual property of __________. __________ has the full right and authority to manage, sell, gift, transfer or otherwise dispose of __________’s separate property. However, the following individual property of __________’s will be considered the marital property of both __________ and __________: __________.

(b) Property earned, acquired and given to __________ individually during marriage will be treated as __________’s own and remain __________’s non-marital, separate and individual property. Any increase in the value relating to the separate property will also remain as the non-marital, separate and individual property of __________. __________ has the full right and authority to manage, sell, gift, transfer or otherwise dispose of __________’s separate property. However, the following individual property of __________’s will be considered the marital property of both __________ and __________: __________.

(c) All assets and property that are earned and acquired by both parties through their joint efforts or given to both parties will be treated as marital property and owned equally by __________ and __________ or as otherwise designated in a writing signed by both parties.

(d) In the event the marriage is terminated, the marital property is subject to division as determined by the jurisdiction whose law governs the construction of this Agreement.

- Premarital Debts. With respect to premarital debts:

(a) __________’s pre-existing debts or obligations listed in Exhibit A that exist prior to the marriage will remain as __________’s sole responsibility during and after the marriage. Any increase in the value of __________’s pre-existing debts or obligations listed in Exhibit A will also remain the sole responsibility of __________. However, the following debts or obligations of __________’s will be considered the marital debt of both __________ and __________: __________.

(b) __________’s pre-existing debts or obligations listed in Exhibit B that exist prior to the marriage will remain as __________’s sole responsibility during and after the marriage. Any increase in the value of __________’s pre-existing debts or obligations listed in Exhibit B will also remain the sole responsibility of __________. However, the following debts or obligations of __________’s will be considered the marital debt of both __________ and __________: __________.

(c) In the event the marriage is terminated, the marital debt is subject to division as determined by the jurisdiction whose law governs the construction of this Agreement.

- Debts Acquired During Marriage. With respect to debts acquired during marriage:

(a) Any debts or obligations incurred by __________ during the marriage will be __________’s sole responsibility. __________ will not assume or become responsible for the debts or obligations due to the marriage without __________’s written consent. __________ will indemnify __________ if a debt or obligation is asserted as a claim or demand against __________’s property and __________ will be responsible for all related expenses including attorney’s fees. However, the following debt of __________’s will be considered the marital debt of both __________ and __________: __________.

(b) Any debts or obligations incurred by __________ during the marriage will be __________’s sole responsibility. __________ will not assume or become responsible for the debts or obligations due to the marriage without __________’s written consent. __________ will indemnify __________ if a debt or obligation is asserted as a claim or demand against __________’s property and __________ will be responsible for all related expenses including attorney’s fees. However, the following debt of __________’s will be considered the marital debt of both __________ and __________: __________.

(c) In the event the marriage is terminated, the marital debt is subject to division determined by the jurisdiction whose law governs the construction of this Agreement.

- Taxes. With respect to taxes:

(a) During their marriage, the parties may elect to file a joint federal and state income tax return, but each party will continue to be liable for any and all taxes associated with their separate property.

(b) In the event the marriage is terminated, tax returns shall be separately filed.

- Binding. This Agreement will inure to the benefit of and be binding upon the parties, their successors, heirs, executors, administrators, assigns and representatives.

- Severability. In the event that any provision of this Agreement is held to be invalid, illegal or unenforceable in whole or in part, the validity, legality and enforceability of the remaining provisions shall not be affected and the remaining provisions shall be construed, to the extent possible, to give effect to this Agreement without the inclusion of such invalid, illegal or unenforceable provision.

- Governing Law. The terms of this Agreement shall be governed by and construed in accordance with the laws of __________, not including its conflicts of law provisions.

- Further Assurances. At the written request of either party, the other party shall execute and deliver such other documents and take such other actions as may be reasonably necessary to effect the terms of this Agreement.

- Headings. The section headings herein are for references purposes only and shall not otherwise affect the meaning, construction or interpretation of any provision in this Agreement.

- Entire Agreement. This Agreement including all Exhibits attached hereto contains the entire understanding between the parties and supersedes and cancels all prior agreements of the parties, whether oral or written, with respect to such subject matter.

- Amendment or Revocation. This Agreement may be amended or modified only by a written agreement signed by both of the parties. This Agreement may be revoked if both parties sign a written agreement before the presence of a notary public or other authorized official. Revocation shall become effective when properly recorded as required by state and local laws.

- Signatures. The signatures of the parties to this Agreement represent the parties acknowledgement that they have been informed of their legal rights, given an adequate amount of time to consider entering into this Agreement, read and understood the Agreement, agree with the contents of the Agreement, had sufficient time to review the Agreement and believe it to be fair, have not been pressured or coerced into signing the Agreement and chosen to freely and voluntarily enter into this Agreement.

Exhibit A

Attach first party’s financial information regarding net worth, assets, income, holdings, liabilities and debts and/or financial statement.

Exhibit B

Attach second party’s financial information regarding net worth, assets, income, holdings, liabilities and debts and/or financial statement.

How to Make Your Prenup Valid

When crafting a prenup, there are two goals you should strive for: a fair process and fair terms. Although courts may take different stances on what is and what isn’t fair, the process by which the prenup is negotiated and the terms of the agreement are usually the same in all 50 states.

In order for a prenuptial agreement to be enforceable in court, it must meet five basic procedural requirements:

- Must be in writing

- Must be signed voluntarily (free of duress or undue pressure)

- Must have been signed after full and fair disclosure

- Must not be unconscionable (must be fair and reasonable)

- Must be signed by both individuals before a witness and notary public

To determine the fairness of the terms of a prenup, a court will look at:

- The ability of each spouse to support themselves after divorce or death

- The goals of both parties entering the agreement

- The amount of property and income each spouse owns

- Family obligations and relationships

- Each spouse’s occupation, education, and earning capacity

- Each spouse’s future needs

- Each spouse’s expected contribution to the marriage

- The age and health, emotional and physical, of each spouse

Prenuptial Agreement FAQs

Spouse Questions

What do the ‘name abbreviations’ mean on prenuptial agreements?

The abbreviated names are shortened names used to refer to each spouse throughout the prenup. For example, if one spouse’s name is “John Doe,” you may choose “John” or “JD” as the abbreviation.

Should we include information about past marital backgrounds, including children from previous marriages? Why?

Yes, both spouses need to disclose whether they have been married before and/or if they have children on their prenuptial agreement.

If one spouse has children from another relationship, this agreement can ensure that their separate premarital property is shared only with their children when that spouse dies.

Even when a will exists, a prenuptial agreement can clarify and reinforce expectations to avoid costly legal battles that ultimately eat away at the estate.

Why is information about wedding dates needed?

The date and location of the wedding indicate the official start date of the marriage of both partners. After the marriage date, the prenuptial agreement becomes legally binding. If either spouse does not have this information on hand, it can be left blank to be filled in later.

Marriage Plan & Legal Representation Questions

Do both spouses need an attorney for the prenup to be legally binding?

ou do not need a prenup lawyer for the agreement to be legally binding. If both partners choose not to have an attorney, they can waive the right to legal representation. By waiving the right to get “independent legal advice” from an attorney representing each person, you both agree to the following statements:

- You both understand the contents of the prenup.

- You both believe it is fair and reasonable.

- You both acknowledge that you entered into the agreement voluntarily.

Ideally, both spouses have an attorney representing their interests. This way, the courts are more likely to honor the prenup, and the spouses are less likely to make costly legal errors. Courts may be worried that the prenup is not fair if only one person had legal representation.

Property Questions

If your marriage ends, how will the marital property be divided?

The division of property can be set by percentages (i.e., first party 50% and second party 50%). Another option is to divide property according to state law. If the couple cannot agree on how to divide property, a judge will decide for them. Usually, property will be divided equitably or fairly based on various factors if the parties did not specify how the property will be split.

I own a business. How will the appreciation in the value of this business be divided in the event of a divorce?

You can choose from four options:

- Grant the appreciation in value to the first spouse entirely

- Grant the appreciation in value to the second spouse entirely

- Share the appreciation equally, or

- Share the appreciation by a percentage

What will happen to my pet?

The law usually treats pets as personal property with no special status. Some courts, however, treat pets like children and apply a similar “best interests of the pet” consideration.

Marital Debt Questions

What is marital debt?

Marital debt includes any financial obligations jointly shared by both you and your partner because of marriage. Each of you is liable for marital debt, even if only one person originally incurred the debt.

I have debts BEFORE entering my marriage. Will my debts be shared with my partner after we are married?

If you have any outstanding loans or financial obligations before getting married, you and your partner can decide in the prenup whether these debts will remain only one person’s responsibility or whether both of you share the responsibility after marriage.

You have three options:

- Keeping your debts before marriage separate

- Designating your debts before marriage as shared

- Keeping everything separate, with exceptions

What if I accrue debts DURING our marriage? Will my partner be responsible for my debts in the event of a divorce?

If you accrue debts, loans, or financial obligations during your marriage, you and your partner can decide whether these debts will remain only one person’s responsibility or be shared in the event of a divorce.

You have three options:

- Keeping your debts accrued during marriage separate

- Designating your debts accrued during marriage as shared

- Keeping everything separate, with exceptions

If my marriage ends, how will marital debts be divided?

The division of debt can be set by percentages (i.e., the first party 50% and second party 50%). The second option is to divide debt in accordance with state law. If the couple cannot decide on a way to divide debt, the couple will need to go to court, and the judge will decide how the property should be divided. Usually, property will be divided equitably or fairly based on various factors if the parties did not specify how the property will be split.

Housing & Household Arrangements

What are some ways my residence can be handled in the event of a divorce?

Owner:

If you or your spouse owns a residence (either separately or shared), you can indicate in a prenuptial agreement how you want the ownership to be affected. You can decide whether to keep ownership separate or shared.

Renter:

If you or your spouse are renting an apartment or home, you can indicate how the lease agreement should be changed in the event of a divorce.

How can we handle expenses related to the residence in the event of a divorce?

You can decide which spouse should be responsible for expenses related to the residence, or share the costs equally. Examples of costs that could be handled:

- Rental/lease payments

- Home insurance premiums

- Maintenance expenses

During our marriage, can we decide on who will pay for which regular household expenses?

Yes, you may. You can stipulate one of the following:

- One person pays all the expenses

- Both people share the expenses equally

- Each person pays for expenses

You can decide what counts as regular household expenses, and what does not.

Items commonly considered as regular household expenses:

- Electricity

- Water

- Gas

- Telephone

- Cable

Items commonly NOT considered as regular household expenses:

- Cellular phone

- Clothing

- Gasoline for car or truck

- Entertainment (movies, baseball games, etc.)

I have a pet that I owned before marriage. Who will get custody after a divorce?

You can stipulate in the prenup who will get custody over the pet if you owned one before marriage.

Specificaties: Prenuptial Agreement

|

User Reviews

Plaats de eerste recensie voor “Prenuptial Agreement”

Informatie verkoper

- Nog geen beoordelingen!

Er zijn nog geen recensies.